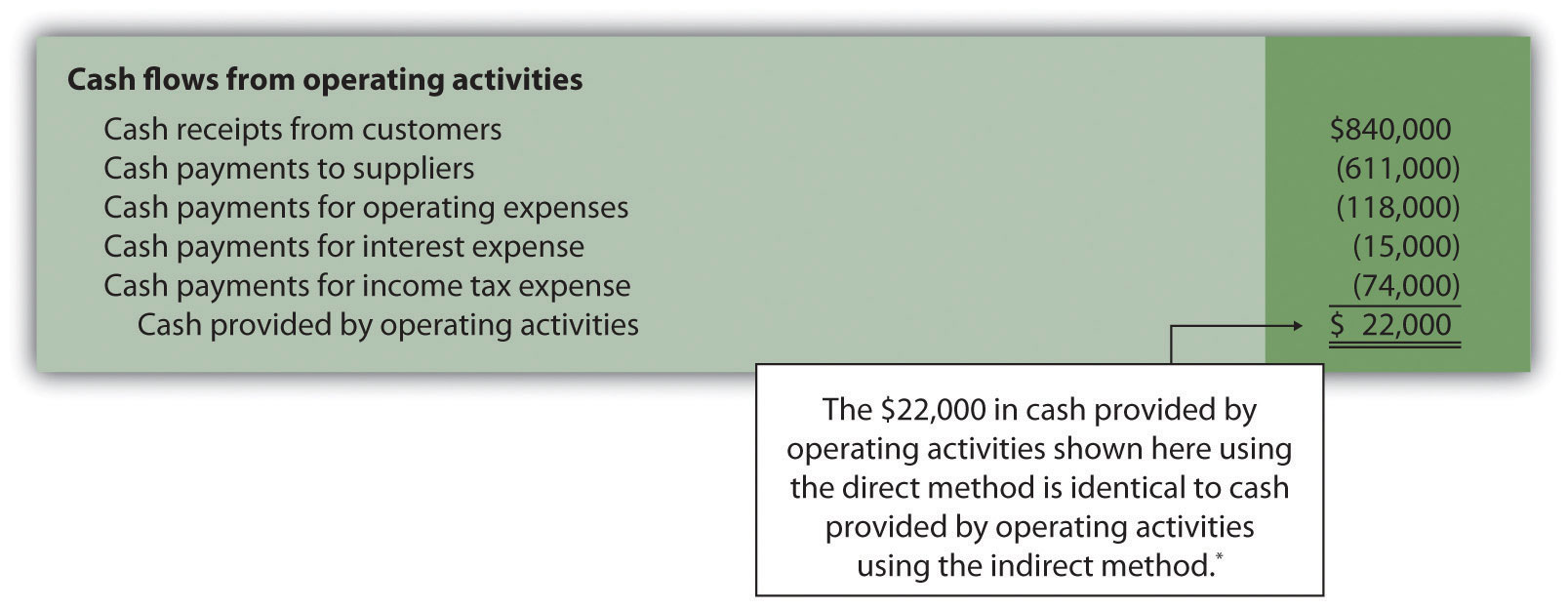

The Direct Method Accounting . the main difference between the direct method and the indirect method of presenting the statement of cash flows. the direct method converts each item on the income statement to a cash basis. It does so by grouping cash transactions into major The direct method is one of the two methods used while preparing a cash flow. what is the direct method? the cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments. For instance, assume that sales are stated at $100,000 on an accrual basis. the main difference between the direct method and the indirect method is that the former uses the cash accounting basis and the. the direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business.

from biz.libretexts.org

It does so by grouping cash transactions into major For instance, assume that sales are stated at $100,000 on an accrual basis. The direct method is one of the two methods used while preparing a cash flow. the direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business. the cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments. the main difference between the direct method and the indirect method is that the former uses the cash accounting basis and the. the direct method converts each item on the income statement to a cash basis. the main difference between the direct method and the indirect method of presenting the statement of cash flows. what is the direct method?

12.7 Appendix Using the Direct Method to Prepare the Statement of

The Direct Method Accounting the direct method converts each item on the income statement to a cash basis. the cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments. For instance, assume that sales are stated at $100,000 on an accrual basis. The direct method is one of the two methods used while preparing a cash flow. the main difference between the direct method and the indirect method is that the former uses the cash accounting basis and the. what is the direct method? the main difference between the direct method and the indirect method of presenting the statement of cash flows. It does so by grouping cash transactions into major the direct method converts each item on the income statement to a cash basis. the direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business.

From www.youtube.com

Topic 12.2 The Direct Write Off and Allowance Methods (Accounting for The Direct Method Accounting the direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business. For instance, assume that sales are stated at $100,000 on an accrual basis. the cash flow statement presented using the direct method is easy to read because it lists all of. The Direct Method Accounting.

From www.versapay.com

Direct vs Indirect Cash Flow Key Differences Versapay The Direct Method Accounting what is the direct method? For instance, assume that sales are stated at $100,000 on an accrual basis. the direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business. the main difference between the direct method and the indirect method of. The Direct Method Accounting.

From www.youtube.com

Managerial Accounting Statement Cash Flow Direct Method YouTube The Direct Method Accounting the cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments. the main difference between the direct method and the indirect method of presenting the statement of cash flows. the direct method converts each item on the income statement to a cash basis.. The Direct Method Accounting.

From saxafund.org

Direct Method Cash Flow Method of Accounting Explained SAXA fund The Direct Method Accounting what is the direct method? For instance, assume that sales are stated at $100,000 on an accrual basis. the cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments. the main difference between the direct method and the indirect method of presenting the. The Direct Method Accounting.

From www.pinterest.com

Direct Method Statement of Cash Flows Explained. CPA exam in 2022 Cpa The Direct Method Accounting the main difference between the direct method and the indirect method of presenting the statement of cash flows. what is the direct method? For instance, assume that sales are stated at $100,000 on an accrual basis. the cash flow statement presented using the direct method is easy to read because it lists all of the major operating. The Direct Method Accounting.

From oer.pressbooks.pub

8.3 Preparing the operating activities section of the statement of cash The Direct Method Accounting For instance, assume that sales are stated at $100,000 on an accrual basis. The direct method is one of the two methods used while preparing a cash flow. the direct method converts each item on the income statement to a cash basis. the direct method is the method preferred by the financial accounting standards board (fasb) because it. The Direct Method Accounting.

From www.youtube.com

Support Cost Allocation Using the Direct Method (Cost Accounting The Direct Method Accounting For instance, assume that sales are stated at $100,000 on an accrual basis. the main difference between the direct method and the indirect method of presenting the statement of cash flows. the main difference between the direct method and the indirect method is that the former uses the cash accounting basis and the. the direct method converts. The Direct Method Accounting.

From www.studypool.com

SOLUTION Accounting cashflow direct method Studypool The Direct Method Accounting It does so by grouping cash transactions into major the main difference between the direct method and the indirect method is that the former uses the cash accounting basis and the. the cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments. The direct. The Direct Method Accounting.

From saylordotorg.github.io

Appendix Using the Direct Method to Prepare the Statement of Cash Flows The Direct Method Accounting It does so by grouping cash transactions into major the direct method converts each item on the income statement to a cash basis. what is the direct method? the direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business. The direct. The Direct Method Accounting.

From paynehishad.blogspot.com

Easy Way to Do Direct Method Cash Flow Statement Payne Hishad The Direct Method Accounting what is the direct method? the cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments. For instance, assume that sales are stated at $100,000 on an accrual basis. the direct method is the method preferred by the financial accounting standards board (fasb). The Direct Method Accounting.

From www.investopedia.com

Direct Method Complexities of Cash Flow Method of Accounting The Direct Method Accounting the main difference between the direct method and the indirect method is that the former uses the cash accounting basis and the. the direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business. what is the direct method? the cash. The Direct Method Accounting.

From www.studypool.com

SOLUTION Accounting cashflow direct method Studypool The Direct Method Accounting the main difference between the direct method and the indirect method is that the former uses the cash accounting basis and the. the main difference between the direct method and the indirect method of presenting the statement of cash flows. It does so by grouping cash transactions into major the direct method converts each item on the. The Direct Method Accounting.

From www.youtube.com

Allowance Method VS Direct Write Off Method Financial Accounting The Direct Method Accounting the cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments. It does so by grouping cash transactions into major For instance, assume that sales are stated at $100,000 on an accrual basis. the direct method converts each item on the income statement to. The Direct Method Accounting.

From oer.pressbooks.pub

8.3 Preparing the operating activities section of the statement of cash The Direct Method Accounting the direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business. the direct method converts each item on the income statement to a cash basis. For instance, assume that sales are stated at $100,000 on an accrual basis. the cash flow. The Direct Method Accounting.

From www.youtube.com

Accounting Direct Method (cost accounting) (ARABIC) YouTube The Direct Method Accounting The direct method is one of the two methods used while preparing a cash flow. It does so by grouping cash transactions into major the main difference between the direct method and the indirect method of presenting the statement of cash flows. the main difference between the direct method and the indirect method is that the former uses. The Direct Method Accounting.

From www.myaccountingcourse.com

Statement of Cash Flows Direct Method Format Example The Direct Method Accounting For instance, assume that sales are stated at $100,000 on an accrual basis. what is the direct method? the cash flow statement presented using the direct method is easy to read because it lists all of the major operating cash receipts and payments. It does so by grouping cash transactions into major the direct method converts each. The Direct Method Accounting.

From www.showme.com

Direct method Accounting ShowMe The Direct Method Accounting the main difference between the direct method and the indirect method is that the former uses the cash accounting basis and the. what is the direct method? For instance, assume that sales are stated at $100,000 on an accrual basis. It does so by grouping cash transactions into major The direct method is one of the two methods. The Direct Method Accounting.

From www.youtube.com

12.1 Cash Flow Statement Direct vs Indirect Method YouTube The Direct Method Accounting the direct method is the method preferred by the financial accounting standards board (fasb) because it gives deeper insights into the movement of cash in a business. the main difference between the direct method and the indirect method of presenting the statement of cash flows. what is the direct method? the main difference between the direct. The Direct Method Accounting.