Real Estate Taxes In Howard County Maryland . real property taxes are billed by howard county on an annual basis on july 1 although many taxpayers have the option of semi. the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. Real property data search ( ) guide to searching the database. for the best experience when paying/viewing howard county property taxes, please consider utilizing google chrome. the maryland department of assessments and taxation administers and enforces the property assessment and property tax. maryland department of assessments and taxation. a property tax credit is available to residential homeowners, regardless of age, who qualify on the basis of a comparison.

from printablemapforyou.com

the maryland department of assessments and taxation administers and enforces the property assessment and property tax. a property tax credit is available to residential homeowners, regardless of age, who qualify on the basis of a comparison. real property taxes are billed by howard county on an annual basis on july 1 although many taxpayers have the option of semi. for the best experience when paying/viewing howard county property taxes, please consider utilizing google chrome. the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. Real property data search ( ) guide to searching the database. maryland department of assessments and taxation.

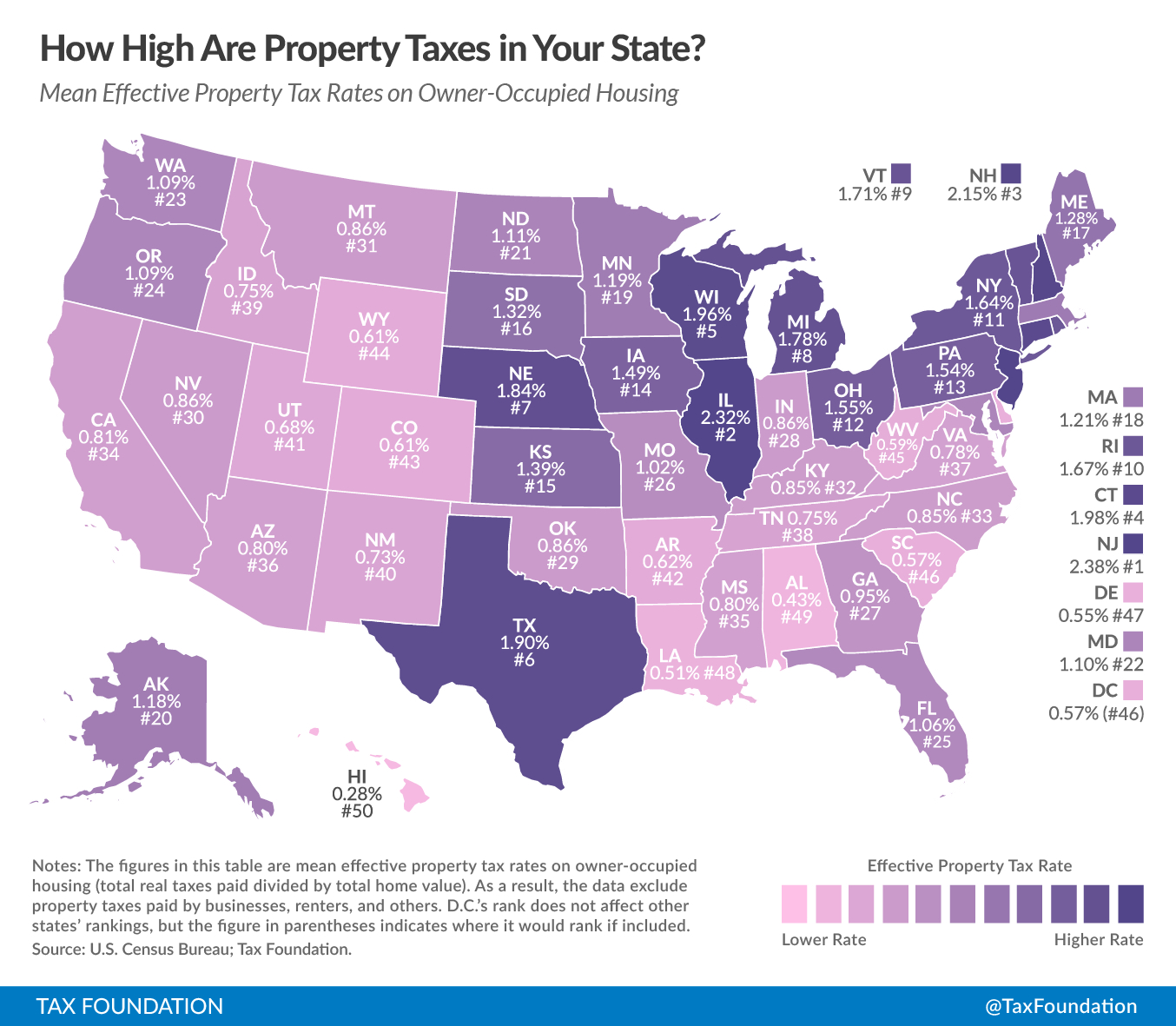

Sales Taxstate Are Grocery Items Taxable? Florida Property Tax Map

Real Estate Taxes In Howard County Maryland a property tax credit is available to residential homeowners, regardless of age, who qualify on the basis of a comparison. maryland department of assessments and taxation. Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. a property tax credit is available to residential homeowners, regardless of age, who qualify on the basis of a comparison. for the best experience when paying/viewing howard county property taxes, please consider utilizing google chrome. Real property data search ( ) guide to searching the database. the maryland department of assessments and taxation administers and enforces the property assessment and property tax. real property taxes are billed by howard county on an annual basis on july 1 although many taxpayers have the option of semi.

From nieciedraper.com

Search Howard County, MD Real Estate Million Dollar Homes For Sale Real Estate Taxes In Howard County Maryland the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. maryland department of assessments and taxation. Real property data search ( ) guide to searching the database. Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached.. Real Estate Taxes In Howard County Maryland.

From dxojvxekx.blob.core.windows.net

Real Estate Taxes Howard County Md at Joshua Thornton blog Real Estate Taxes In Howard County Maryland the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. a property tax credit is available to residential homeowners, regardless of age, who qualify on the basis. Real Estate Taxes In Howard County Maryland.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State Real Estate Taxes In Howard County Maryland Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. real property taxes are billed by howard county on an annual basis on july 1 although many taxpayers have the option of semi. for the best experience when paying/viewing howard county property taxes, please consider utilizing google chrome. Real property data. Real Estate Taxes In Howard County Maryland.

From www.realtor.com

Page 6 Howard County, MD Real Estate & Homes for Sale Real Estate Taxes In Howard County Maryland a property tax credit is available to residential homeowners, regardless of age, who qualify on the basis of a comparison. Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median. Real Estate Taxes In Howard County Maryland.

From infogram.com

Maryland property tax bills by county Infogram Real Estate Taxes In Howard County Maryland the maryland department of assessments and taxation administers and enforces the property assessment and property tax. the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. . Real Estate Taxes In Howard County Maryland.

From dxojvxekx.blob.core.windows.net

Real Estate Taxes Howard County Md at Joshua Thornton blog Real Estate Taxes In Howard County Maryland maryland department of assessments and taxation. a property tax credit is available to residential homeowners, regardless of age, who qualify on the basis of a comparison. real property taxes are billed by howard county on an annual basis on july 1 although many taxpayers have the option of semi. for the best experience when paying/viewing howard. Real Estate Taxes In Howard County Maryland.

From exoxvgtvp.blob.core.windows.net

Howard County Md Tax Rate at Jamie Chandler blog Real Estate Taxes In Howard County Maryland Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. real property taxes are billed by howard county on an annual basis on july 1 although many taxpayers have the option of semi. Real property data search ( ) guide to searching the database. maryland department of assessments and taxation. . Real Estate Taxes In Howard County Maryland.

From www.northroprealty.com

Real Estate For Sale In Howard County, MD Northrop Realty Listings Real Estate Taxes In Howard County Maryland the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. maryland department of assessments and taxation. Real property data search ( ) guide to searching the database. a property tax credit is available to residential homeowners, regardless of age, who qualify on the. Real Estate Taxes In Howard County Maryland.

From www.land.com

2.96 acres in Howard County, Maryland Real Estate Taxes In Howard County Maryland Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. maryland department of assessments and taxation. a property tax credit is available to residential homeowners, regardless of age, who qualify on the basis of a comparison. the median property tax (also known as real estate tax) in howard county is. Real Estate Taxes In Howard County Maryland.

From exohvnbkz.blob.core.windows.net

Linn County Iowa Real Estate Taxes at Diana Chapman blog Real Estate Taxes In Howard County Maryland the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. a property tax credit is available to residential homeowners, regardless of age, who qualify on the basis of a comparison. maryland department of assessments and taxation. real property taxes are billed by. Real Estate Taxes In Howard County Maryland.

From www.realtor.com

Howard County, MD Real Estate & Homes for Sale Real Estate Taxes In Howard County Maryland real property taxes are billed by howard county on an annual basis on july 1 although many taxpayers have the option of semi. Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. Real property data search ( ) guide to searching the database. a property tax credit is available to. Real Estate Taxes In Howard County Maryland.

From head.hesge.ch

Buffalo County Real Estate Taxes Discount head.hesge.ch Real Estate Taxes In Howard County Maryland the maryland department of assessments and taxation administers and enforces the property assessment and property tax. the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. Real property data search ( ) guide to searching the database. maryland department of assessments and taxation.. Real Estate Taxes In Howard County Maryland.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Real Estate Taxes In Howard County Maryland Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. the maryland department of assessments and taxation administers and enforces the property assessment and property tax. for the best experience when paying/viewing howard county property taxes, please consider utilizing google chrome. real property taxes are billed by howard county on. Real Estate Taxes In Howard County Maryland.

From nickolasallman.blogspot.com

Nickolas Allman Real Estate Taxes In Howard County Maryland real property taxes are billed by howard county on an annual basis on july 1 although many taxpayers have the option of semi. maryland department of assessments and taxation. Real property data search ( ) guide to searching the database. the maryland department of assessments and taxation administers and enforces the property assessment and property tax. . Real Estate Taxes In Howard County Maryland.

From midatlantic.thespeichergroup.com

MillionDollar Real Estate in Montgomery and Howard Counties, MD The Real Estate Taxes In Howard County Maryland Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. a property tax credit is available to residential homeowners, regardless of age, who qualify on the basis. Real Estate Taxes In Howard County Maryland.

From nieciedraper.com

Search Howard County, MD Real Estate Town House Homes For Sale Real Estate Taxes In Howard County Maryland the maryland department of assessments and taxation administers and enforces the property assessment and property tax. maryland department of assessments and taxation. the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. Property owners are charged a tax for land plus the buildings. Real Estate Taxes In Howard County Maryland.

From activerain.com

COLUMBIA MARYLAND SINGLE FAMILY HOMES. REAL ESTATE PRICES IN HOWARD Real Estate Taxes In Howard County Maryland the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. for the best experience when paying/viewing howard county property taxes, please consider utilizing google chrome. Property owners are charged a tax for land plus the buildings and fixtures that are permanently attached. the. Real Estate Taxes In Howard County Maryland.

From www.realtor.com

Howard County, MD Real Estate & Homes for Sale Real Estate Taxes In Howard County Maryland maryland department of assessments and taxation. Real property data search ( ) guide to searching the database. the median property tax (also known as real estate tax) in howard county is $4,261.00 per year, based on a median home value of. real property taxes are billed by howard county on an annual basis on july 1 although. Real Estate Taxes In Howard County Maryland.